Forget the technical jargon. Think of Account Abstraction (AA) not as a protocol upgrade, but as a user experience upgrade that you can finally build on top of the blockchain.

Imagine if every new customer to your online store had to first build their own wallet, hand-craft a payment card, and buy a special currency just to pay shipping fees. They’d leave immediately. Yet, this is exactly what we’ve asked of Web3 users for years.

Account Abstraction fixes this at the core.

The Shift: From “Locked Safes” to “Smart Accounts”

Today, most blockchain accounts (known as Externally Owned Accounts or EOAs, like a standard MetaMask wallet) are like a locked safe with a single, irreplaceable key. If you lose the key, the assets are gone forever. To move anything, you must personally handle the key and pay “gas” fee in a specific currency.

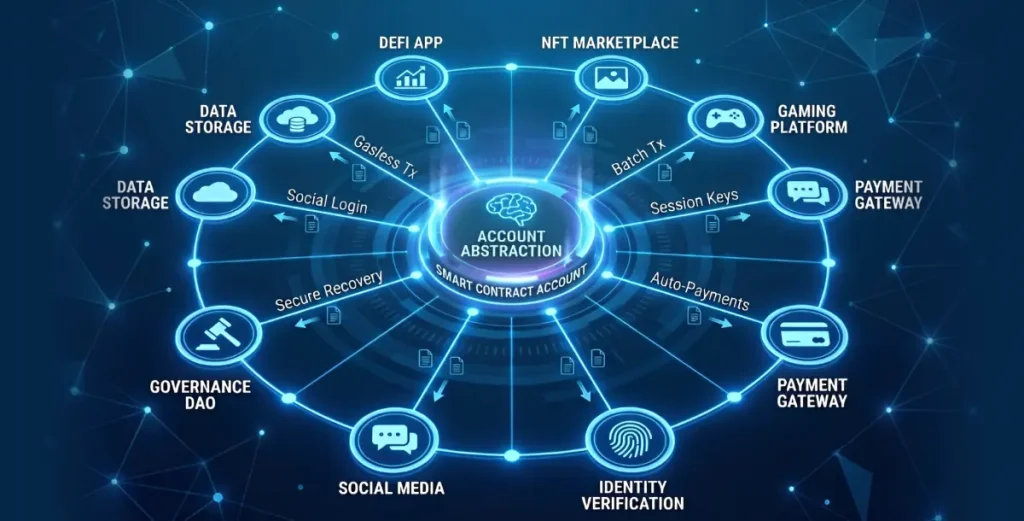

With Account Abstraction, a user’s account becomes a smart, programmable “bank account” instead of a simple “safe.” As a business, you can help design what that account looks like and how it works for your customers::

- Social recovery: Let a user recover access via email, a trusted device, or a “guardian” – no seed phrases required.

- Spending rules: Set daily limits or whitelist specific smart contracts for enhanced security.

- Flexible payment: Let users pay transaction fees in your app’s token, a stablecoin like USDC, or you can sponsor the fees for them as a customer acquisition cost.

- Batch actions: Let a user approve a complex, multi-step action (e.g., “buy NFT, list it for sale, and stake the revenue”) in one click, instead of signing 5 separate transactions.

How the Magic Works: ERC-4337

The standard marking this possible is ERC-4337. Think of it as a new, parallel service layer for the blockchain—like adding a concierge desk to a hotel. The heavy infrastructure (the blockchain) stays the same, but now there’s a service layer that can handle complexity on the user’s behalf.

- User Gives an “Intent”: Your customer just clicks “Subscribe” or “Buy.” They aren’t signing a cryptic transaction; they’re signing a simple intent.

- A Network Helper (“Bundler”) Steps In: This intent is sent to a network of helpers. They bundle thousands of user intents together, handle the complex blockchain execution, and pay the upfront fees.

- You Control the Payment Layer (“Paymaster”): This is your business tool. You decide: does the user pay in their preferred currency? Do you cover the fee as a promotion? The Paymaster handles this seamlessly, abstracting away the gas fee complexity.

- The Smart Account Executes: The user’s programmable account—with the rules you helped set up—receives the instruction and securely completes the action.

You are no longer constrained by the blockchain’s rigid user model. Account Abstraction gives you the toolbox to build familiar, safe, and flexible onboarding and transaction flows. You can remove the friction that loses 99% of your potential users at the door, while giving the remaining users a dramatically more powerful and secure experience.

It’s the foundation for turning blockchain from a niche tool into a viable backbone for mainstream digital products.

What Account Abstraction Actually Does for Users

For users, Account Abstraction dismantles the confusing, technical hurdles that have defined Web3 for years. It replaces the anxiety of managing seed phrases, browser extensions, and network settings with the calm familiarity of logging in via email, social accounts, or a device’s biometrics. It’s a restoration of confidence. The user’s first thought is no longer “Can I figure this out?” but “What can I do here?”

The friction evaporates in their daily interactions. Gas fees—a constant source of confusion and unexpected costs—simply disappear from view. Whether the platform sponsors them or they pay in a stable dollar equivalent, users experience predictable pricing. They are freed from the frustrating ritual of buying a specific cryptocurrency just to perform an action, making every transaction feel as straightforward as an online checkout. This invisibility of complexity allows them to engage with the value of the application, not its plumbing.

Security transforms from a high-stakes burden into an intuitive, empowering feature. Losing a device is an inconvenience, not a catastrophe, thanks to social recovery options that let trusted contacts help restore access. Users feel in control, setting personal spending limits and whitelisting only the apps they trust, much like managing a modern bank account. The constant fear of making a single, irreversible mistake is replaced by a sense of built-in protection.

Ultimately, the feeling is one of effortless ownership. Users experience the unique benefits of blockchain—true asset ownership, interoperability, and transparency—without the cognitive overhead. They can execute sophisticated, multi-step actions with a single approval, making advanced DeFi or gaming workflows feel seamless. Account Abstraction makes the blockchain itself fade into the background, enabling people to focus entirely on what drew them in: the experience, the community, and the value.

Why Account Abstraction Is Your Unfair Competitive Advantage

Building on blockchain isn’t just about technology—it’s about customer adoption. For years, businesses have faced an impossible choice: leverage blockchain’s unique capabilities while accepting that 95% of potential users will abandon the process due to wallet complexity, or build a traditional web2 application and lose the core advantages of decentralization. Account Abstraction breaks this trade-off.

This isn’t a marginal improvement. It’s a fundamental rearchitecture of how users experience blockchain through your product. The business implications are profound across four critical dimensions:

1. Onboarding: From Friction to Flow

The Problem: The traditional crypto onboarding funnel is a leaky bucket. Asking users to install a browser extension, safely store a 12-24 word phrase they don’t understand, and fund their wallet with a specific cryptocurrency before they can even try your product is conversion suicide. It’s the digital equivalent of requiring customers to build their own cash register before shopping.

The AA Solution: With smart accounts, you can create zero-friction onboarding paths that feel native to your audience.

- B2C Example: A gaming platform can let players sign in with their Google or Apple ID, instantly generating a secure smart wallet in the background. The player never sees “wallet,” “private key,” or “gas”—they just click “Play Now” and start collecting assets they truly own.

- B2B Example: An enterprise DeFi platform can integrate with company SSO (Single Sign-On) providers. Employees get role-based smart wallets with pre-configured permissions, eliminating shadow IT while maintaining audit trails on-chain.

The Business Impact: 10-100x improvement in conversion rates from visitor to active user. You’re no longer marketing to “crypto natives”—you’re marketing to gamers, creators, investors, and professionals who want specific outcomes, not blockchain education.

2. Monetization: From Friction to Flexibility

The Problem: Gas fees aren’t just a technical detail—they’re a business model constraint. Requiring users to hold Ethereum (or another native token) creates unpredictable pricing, exposes them to volatility, and adds mental overhead to every microtransaction. This kills emerging models like pay-per-use, micro-tipping, and fractional ownership.

The AA Solution: The Paymaster model gives you complete control over the payment experience.

- Sponsored Transactions: You can pay gas fees for users as a customer acquisition cost—like offering free shipping. A social platform could sponsor all transactions under $1 to enable micro-tipping between creators and fans.

- Pay in Any Token: Let users pay fees in your platform token, a stablecoin, or even deduct fees from the transaction itself. An Non-Fungible Token (NFT) marketplace could let users mint with just a credit card, abstracting all crypto complexity.

- Subscription Models: Implement true recurring revenue with automated transactions. A decentralized storage service could charge a monthly USDC fee that’s automatically deducted from the user’s smart account without manual approvals.

The Business Impact: Predictable pricing, expanded payment options, and new revenue models that were previously impossible. You can design monetization around user behavior rather than blockchain constraints.

3. Security: From Liability to Feature

The Problem: Traditional wallets put 100% of the security burden on users who are unprepared for it. Lost keys mean lost funds—a customer service nightmare and brand-destroying event. Businesses have been forced to watch helplessly as customers make irreversible mistakes.

The AA Solution: Smart accounts let you build proactive security directly into the product experience.

- Social Recovery: Users can designate 3-5 trusted contacts who can collectively help restore access. This transforms security from “memorize this phrase” to “choose your recovery team.”

- Transaction Rules: Implement spending limits, time locks, and whitelists. A family financial app could give teens smart wallets that only interact with approved educational platforms, with daily spending caps.

- Enterprise Controls: Companies can implement multi-signature requirements for large transactions, with hierarchical approval flows that mirror organizational structure.

The Business Impact: Reduced liability, enhanced trust, and competitive differentiation through superior security. You’re not just another crypto app—you’re the safe, professional option for mainstream users and institutions.

4. Product Innovation: From Limitations to Possibilities

The Problem: Traditional wallets limit interactions to simple, one-off transactions. This makes complex workflows—anything involving multiple steps or conditional logic—painful for users and impractical for businesses to implement.

The AA Solution: Smart accounts are programmable, enabling multi-step operations as single user experiences.

- One-Click Workflows: A Decentralized Finance (DeFi) user could click “Optimize My Yield” once, and their smart wallet automatically performs 5 transactions across multiple protocols to achieve the best return, with all fees bundled.

- Conditional Logic: A trading platform could let users set up “If the price of Ethereum drops below $3,000, buy $500 worth” orders that execute without further interaction.

- Session Keys: Gaming platforms can create temporary signing keys with limited permissions, letting users play for hours without constant transaction pop-ups, while maintaining full security.

The Business Impact: You can build sophisticated products that compete with—and surpass—traditional financial and gaming platforms on user experience, while retaining blockchain’s unique advantages like transparency and user ownership.

The Strategic Imperative

The businesses that will dominate the next generation of digital services won’t be those that simply port web2 experiences to blockchain. They’ll be those that leverage Account Abstraction to create entirely new categories of products—products that combine blockchain’s superpowers (true ownership, interoperability, transparency) with mainstream-grade user experience.

You can:

- Capture the mainstream market by removing the technical barriers that have kept them out

- Build stronger moats through superior User Experience (UX) and security that’s difficult for traditional apps to replicate

- Create network effects by making your platform not just usable but delightful for non-technical users

- Unlock new revenue streams through business models that were previously impossible

Account Abstraction isn’t just another feature—it’s the key that unlocks blockchain’s true business potential.

How Account Abstraction Upgrades the Products You Already Have

This isn’t about rebuilding from scratch. Account Abstraction is a layer you can integrate to enhance your current offerings, transforming them with blockchain’s unique advantages while preserving the user-friendly experience your customers expect.

For Fintech and TradFi Platforms, AA enables you to offer crypto and DeFi products that feel as simple, safe, and familiar as traditional finance. Users can seamlessly deposit funds, earn yield across protocols, and rebalance portfolios automatically through smart, programmable rules—all without the daunting responsibility of safeguarding a private key. This removal of private key risk, combined with programmable institutional-grade treasury controls like multi-signature approvals and spending limits, makes advanced crypto treasury management accessible without the need for complex custom infrastructure or specialized operational teams. You can finally bridge the gap between traditional finance and decentralized innovation.

For Gaming and Social Platforms, Account Abstraction makes truly immersive digital economies a reality. In-game purchases, peer-to-peer item trading, and the claiming of blockchain-based rewards become frictionless background processes. Players can engage with asset ownership and player-driven economies without ever encountering seed phrases, network settings, or disruptive gas fee prompts. AA allows the user’s focus to remain entirely on gameplay, social interaction, and community, while their smart account quietly handles all security, verification, and transaction execution in the background. This unlocks new models for creator monetization, digital collectibles, and community governance.

For Marketplaces and E-commerce, you can now design a crypto-native checkout experience that rivals the simplicity of Apple Pay or a one-click online purchase. First-time buyers can complete a transaction in their local currency or a familiar stablecoin without first needing to acquire a native token for gas, as merchants can sponsor these fees to dramatically boost conversion rates. Payments can be accepted in any major token, and built-in smart account logic can automate escrow, enable programmable purchase protection, and facilitate smoother refunds or dispute resolution—all living within the user’s own secure wallet. This turns crypto from a payment novelty into a competitive advantage.

For Enterprise Software-as-a-Service (SaaS) and Corporate Teams, Account Abstraction brings the necessary structure and control to make blockchain operations viable for regulated organizations. Smart accounts enable customizable multi-signature approval flows that mirror corporate hierarchies, role-based spending permissions, automated transaction reporting, and unified audit logs for compliance. This seamlessly aligns on-chain activity with traditional governance, procurement, and risk management workflows, allowing enterprises to leverage blockchain for supply chain transparency, digital asset management, and automated finance with confidence and control.

Seizing the Strategic Advantage: A New Era of Market Leadership

We are at the dawn of the “Smart Account” era. This represents more than a technological shift; it is a foundational market realignment. The defining opportunity lies in being the first in your sector to deliver a truly frictionless, secure, and feature-rich blockchain experience. Early adopters will set the new standard for user expectations, capturing mindshare and market share much like pioneering mobile apps and SaaS platforms defined the last decade of digital innovation. As Account Abstraction rapidly becomes the default standard across the Ethereum and Layer 2 (L2) ecosystems, businesses that integrate today are not just keeping pace—they are architecting a long-term competitive moat.

- New Business Models: Subscription services, gasless marketplaces, and programmable loyalty programs become viable.

- Competitive Advantage: Platforms that eliminate wallet friction will see higher conversion, retention, and user satisfaction.

- Institutional Entry: The enhanced security and policy controls make blockchain solutions palatable for larger enterprises and regulated entities.

In essence, Account Abstraction is a market expansion event of the highest order. It systematically removes the barriers that have confined blockchain to a technical niche, opening the floodgates to mainstream users and global enterprises. The next decade of Web3 adoption will be written by the first movers who act now.

Ready to turn this strategic vision into your competitive reality? If you are exploring how to integrate next-generation solutions like Account Abstraction into your platform, speak to the experts at ChainUp.

ChainUp offers comprehensive crypto platform infrastructure—from secure custody and exchange systems to liquidity technology and bespoke Web3 development to build your next-gen crypto endeavors. Partner with ChainUp to build, integrate, and scale the seamless, secure experiences that will define the future of your industry.